What You Can Do Inside ThetaEdge - Guide

ThetaEdge is built for one purpose: to help self-directed investors unlock professional-grade options insights — without surrendering control.

Over the past few months, we’ve been hard at work improving every corner of the platform — refining the experience, expanding capabilities, and adding new features that make ThetaEdge more powerful and intuitive than ever.

Getting Started

Connect Your Brokerage or Add Positions Manually

Link your brokerage via SnapTrade. No matter connection type your funds stay exactly where they are. ThetaEdge simply reads your portfolio to identify opportunities.

Or add positions manually - and add as many tickers as you want.

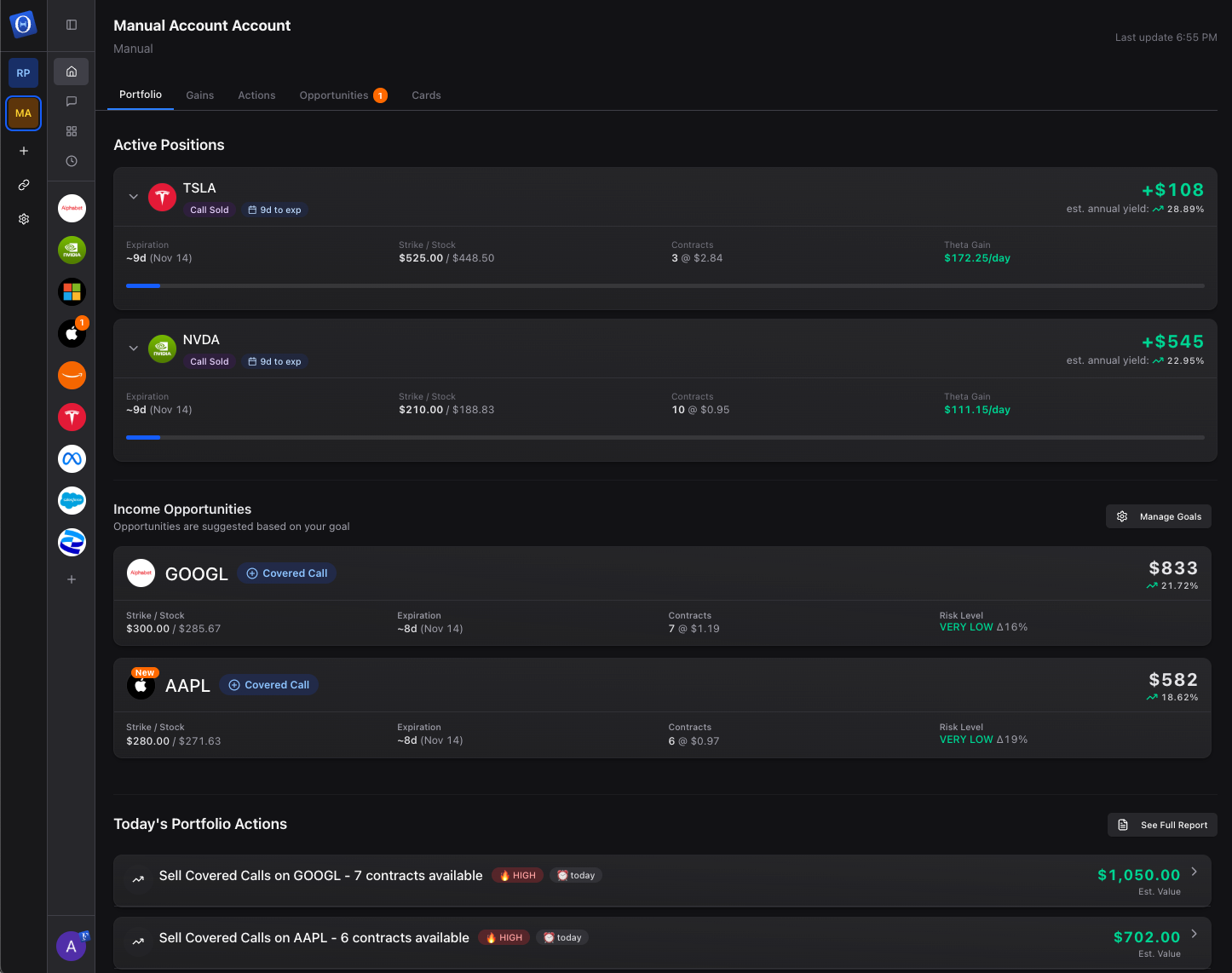

Explore Your Portfolio Dashboard

Once your data is processed, you’ll see the main dashboard — your command center for the day.

On Portfolio tab you’ll find:

- Active Positions – a clear view of your current holdings

- Income Opportunities – potential covered-call setups

- Today’s Actions – reminders and follow-ups surfaced daily

Everything you need to follow is summarized here — no switching tabs or juggling spreadsheets.

Set Trading Goals per Equity

Each stock you own can have its own goal strategy:

- Conservative

- Balanced

- Aggressive

And flexible trading frequency - Weekly or Monthly

ThetaEdge adjusts its analysis accordingly - recommending different strike zones, expiries, and trade structures to align with your intent. Goals can be adjusted as many times as needed.

You can also set up position allocation share you wish to use in trade at Goals Tab.

Goals Tab

Exploring Opportunities

Open an Opportunity Card

Covered-Call Opportunities are the heart of ThetaEdge — and the main way investors interact with the platform today. Each opportunity represents a full professional analysis of a potential covered-call trade drawn directly from your portfolio.

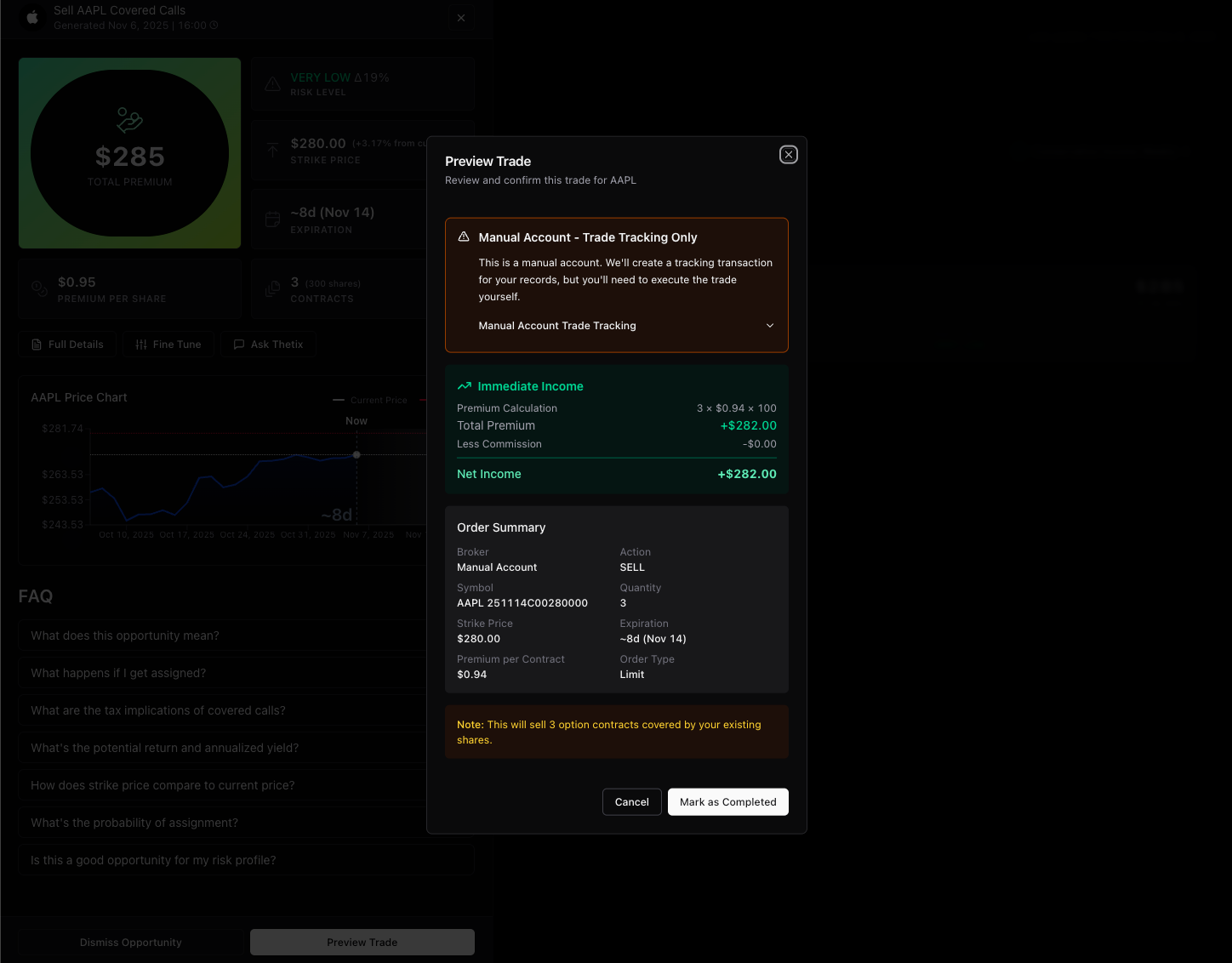

When you open a Covered-Call Opportunity, you’ll see:

- Total Expected Premium — your projected income potential for the selected contract.

- Risk/Reward Analysis — a clear visualization of upside, downside, and assignment probability.

- Fine-Tuning Tab — adjust strike, expiry, or contract size to match your goal — whether it’s steady monthly income, conservative protection, or balanced growth.

These opportunities are generated continuously from our analytics engine - scanning market data, volatility shifts, and your live holdings to reveal setups that meet your criteria.

They are the main entry point inside ThetaEdge, where insight becomes action and every trade remains fully under your control.

Opportunity Example

Ask Thetix AI

Each opportunity comes with a Thetix agent — your AI-powered research assistant.

Ask anything in plain English, like:

- “What’s the probability this call expires worthless?”

- “How does this compare to my previous trades?”

- “What happens if volatility rises?”

You can also pick from preset questions if you’re exploring for the first time. Thetix replies with clear, data-backed insights — no jargon, just professional context.

Opportunities - Ask Thetix

Preview and Execute

When you’re satisfied with the setup, use Preview Trade to review details./Then, move the numbers directly into your brokerage.

Execution remains 100 % in your hands — ThetaEdge never touches your account or auto-trades.

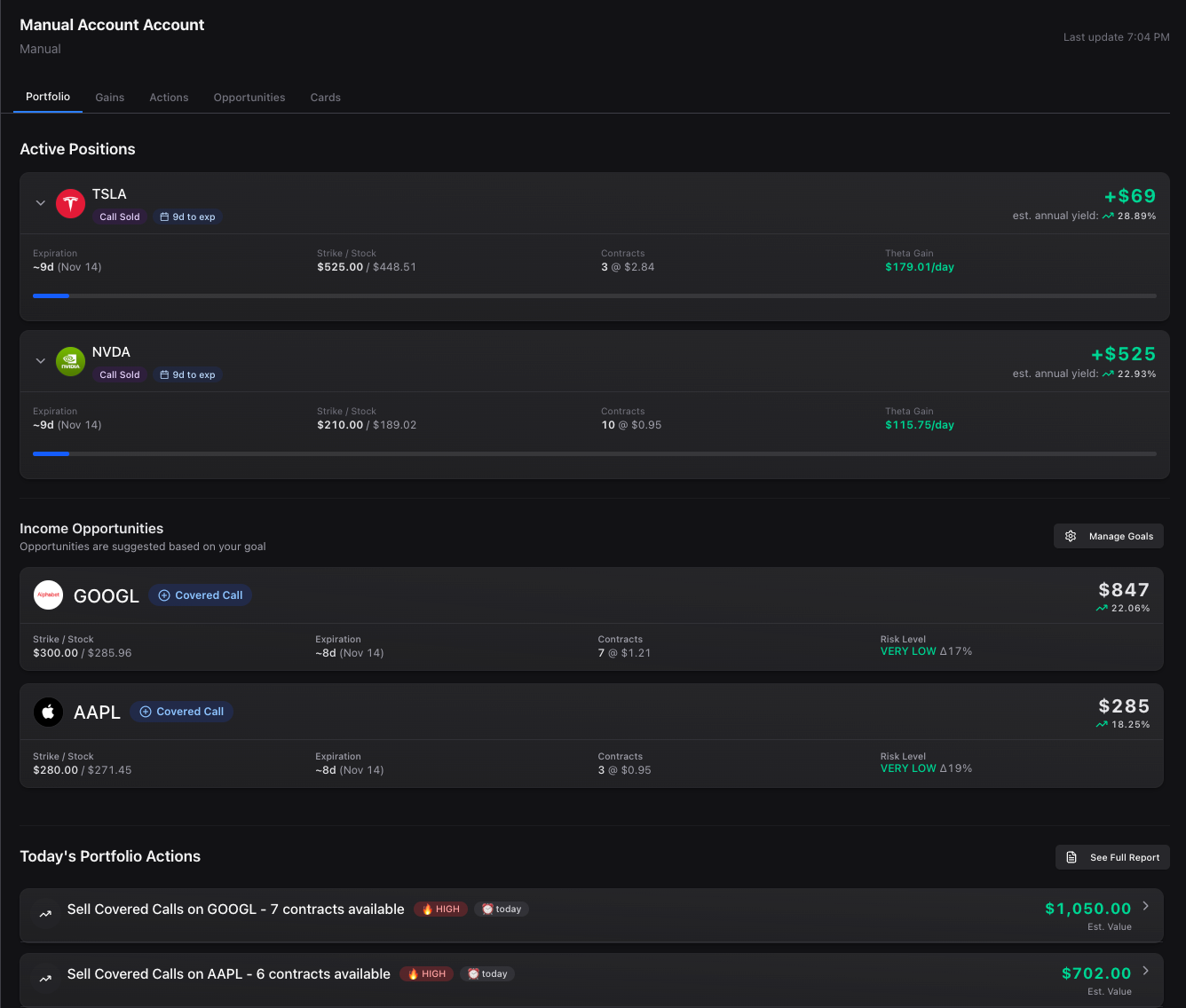

Track Active Positions

Once your trade is live, it automatically appears in your portfolio view, updating alongside your open positions.

You’ll see performance metrics, upcoming expirations, and alerts for potential rolls or closures.

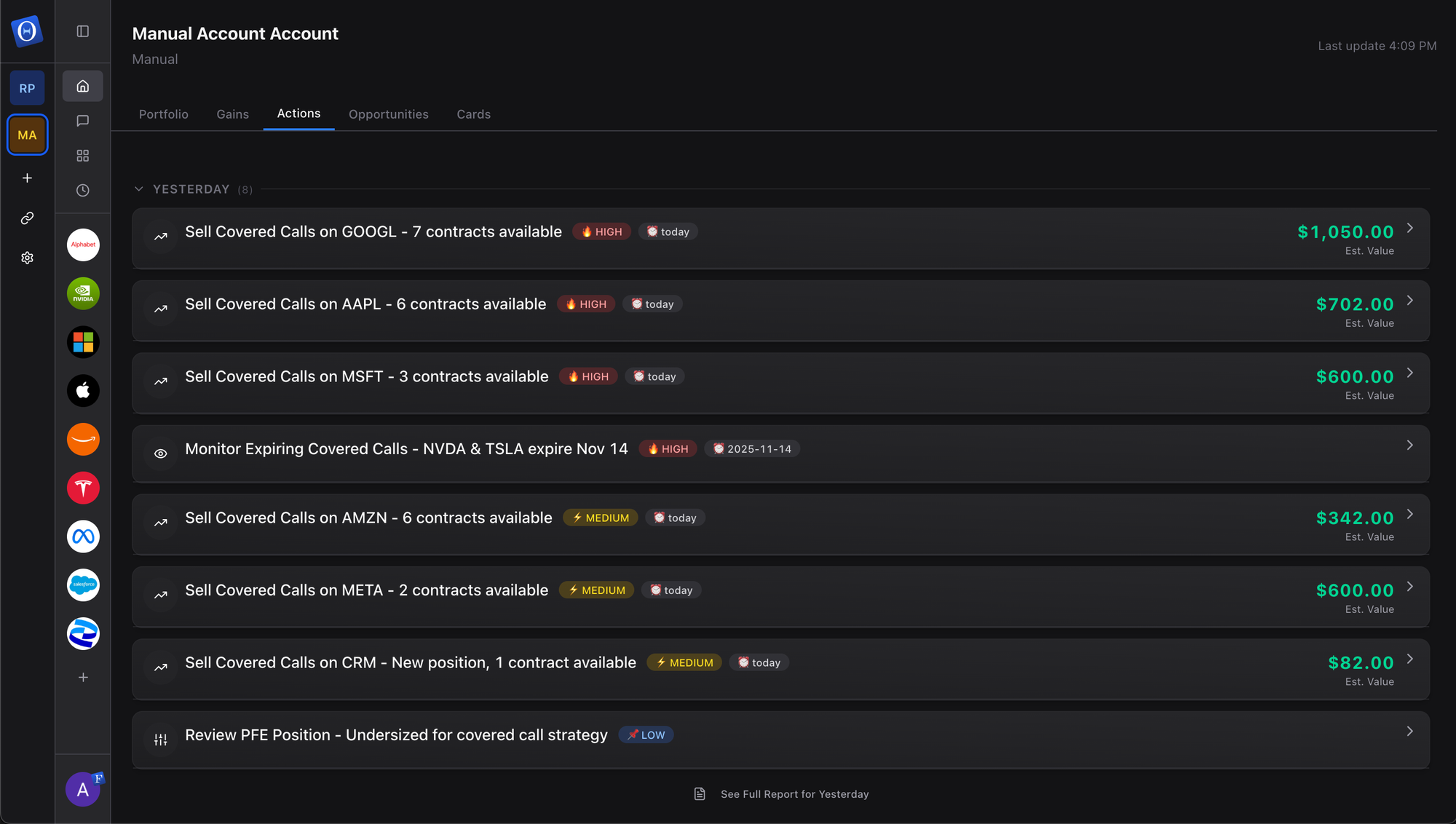

Actions & Daily Recommendations

The Actions tab surfaces not only new covered-call opportunities but also next steps for your active positions and portfolio-level recommendations.

Reports update daily, reflecting market moves, implied volatility shifts, and new income chances.

Think of it as your personal analyst check-in — always current, never pushy.

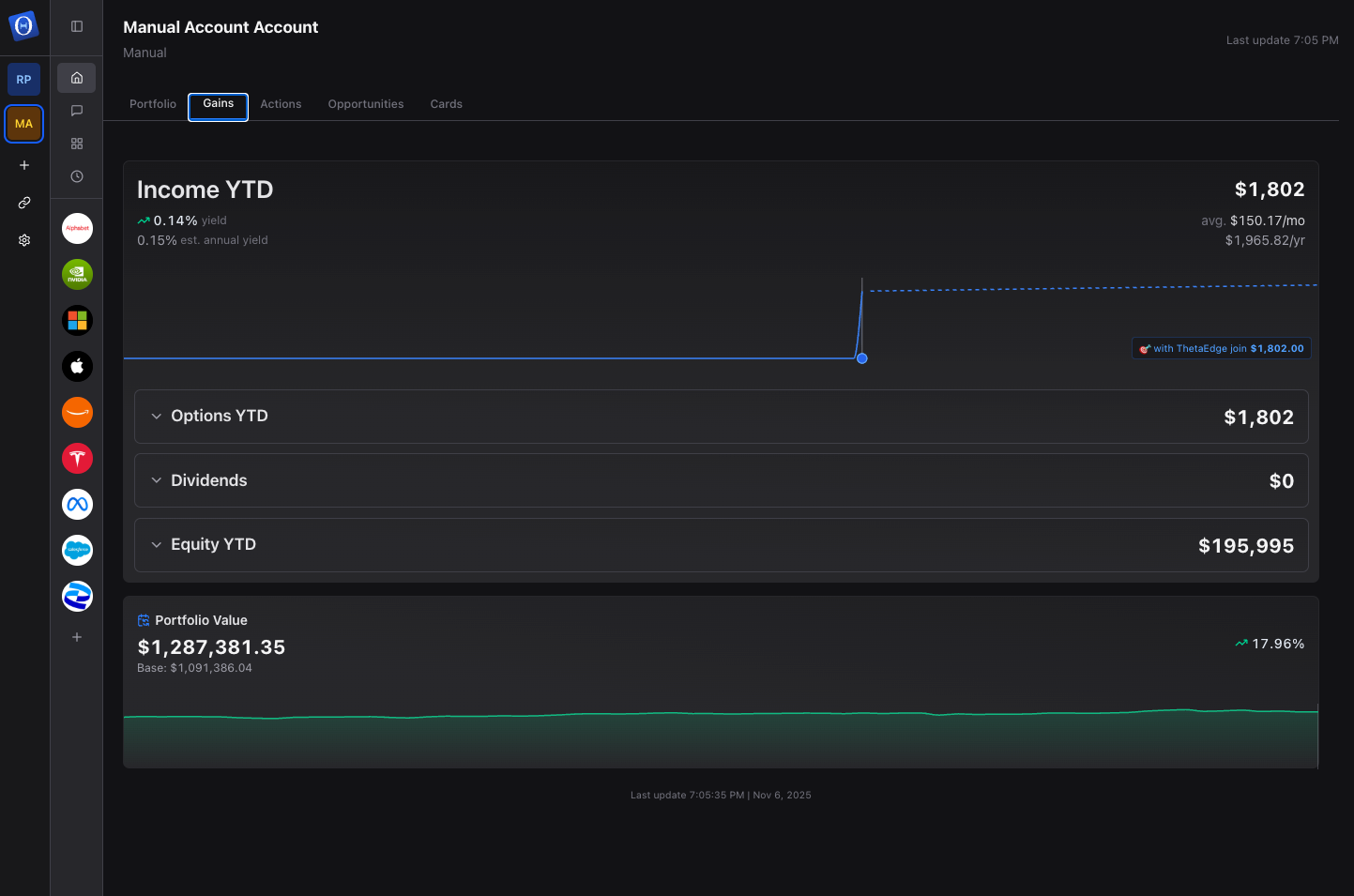

Gains & Performance Analytics

The Gains tab tracks the financial heartbeat of your portfolio — annualized, position-by-position.

Here you can monitor:

- Premium income earned

- Realized P/L from closed trades

- Annualized yield across your positions

This is where long-term discipline pays off: you see how every decision compounds over time.

Cards Powered by Thetix

Cards are your personal professional analytics dashboard powered by Thetix AI, built entirely from natural-language prompts.

Ask Thetix to:

- “Show top stocks with rising IV this week.”

- “Visualize how news impacted AAPL price.”

- “Track my monthly premium trend.”

Thetix transforms these into dynamic cards that update automatically as data changes. Combine multiple cards to create your own professional-grade workspace — from watchlists to sentiment trackers.

Thetix cards

Summing It Up

ThetaEdge brings together everything a self-directed investor needs to make smarter, calmer, and more confident decisions — all in one place.

You start by connecting your portfolio and instantly seeing how your holdings translate into potential income.

From there, Covered-Call Opportunities surface automatically — each one analyzed, visualized, and explained in plain English. You can fine-tune strikes, expiries, and risk levels to fit your own strategy, not someone else’s.

Whenever you want deeper context, Thetix AI is there to clarify the “why” behind every setup — translating data into insight so you stay in control and informed.

Your dashboard keeps everything organized: open positions, daily actions, and a running view of your portfolio’s performance over time.

The result is a platform designed to do what most tools don’t — simplify without dumbing down, empower without automating, and help you act with confidence, not noise.